Your Guide to Chargebacks and How to Shield Your Business From Them

Accepting business and purchasing cards can be incredibly lucrative and, if you’re not careful, equally dangerous. A 2016 study by Lexis Nexis found that, due to product-loss, fines, and administrative costs, chargeback fraud costs merchants $2.40 for every $1 lost. Keep reading for more information on how to protect your sales and prevent chargebacks before they happen.

What is a chargeback?

Every business is potentially subject to a chargeback! A chargeback occurs when a cardholder disputes a transaction directly with the card issuer and can be initiated for a variety of reasons, including fraud, dissatisfaction with a purchase, product failure, etc. The chargeback process bypasses the merchant and allows the cardholder to work directly with the bank that issued their credit card.

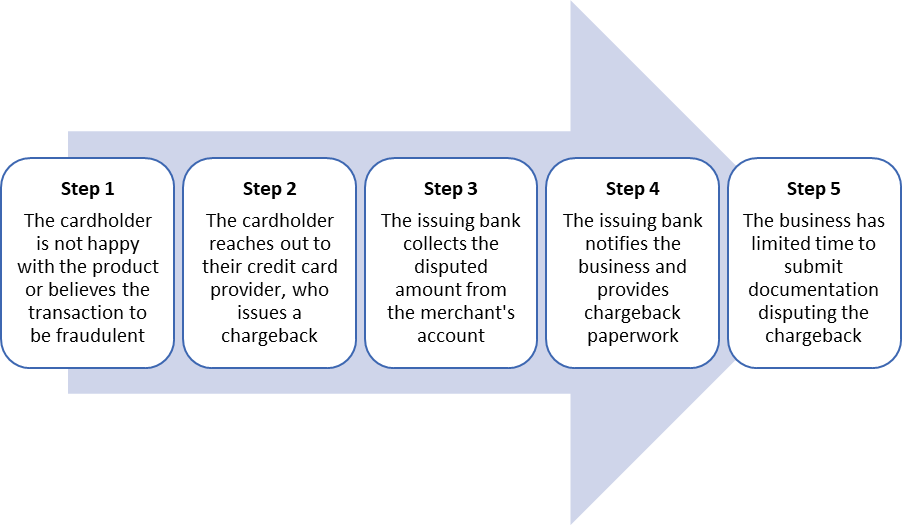

How does a chargeback work?

What happens next?

Scenario 1: The chargeback is resolved in the business’s favor. In this scenario, the “on hold” funds are returned to the merchant’s bank account.

Scenario 2: The chargeback is resolved in the cardholder’s favor. In this scenario, the “on hold” funds are returned to the cardholder’s bank account.

For businesses that have received a chargeback, scenario 1 is the ideal resolution, and if your processor is a real partner, their goal should be to help you achieve that resolution as often as possible. Unfortunately, in the event of the second scenario, you not only lose the funds but potentially the rendered products or services as well.

The 3 types of chargebacks

Friendly Fraud

Friendly fraud occurs when the cardholder initiates a chargeback without malicious intent. This most often occurs when the client forgets about making a purchase or doesn’t recognize a charge on their credit card statement. This type of fraud makes up 35.5% of all chargebacks.

Chargeback Fraud

Chargeback fraud occurs when a cardholder initiates a chargeback with malicious intent. Usually, the goal of the chargeback is regaining the purchase amount and ALSO retaining the received products or rendered services. This type of fraud makes up 35.5% of all chargebacks.

True Fraud

True fraud is associated with identity theft and occurs when a fraudster uses stolen card information to complete a transaction. When the cardholder is alerted to the fraudulent transaction, they dispute the purchase. A chargeback that is the result of true fraud CANNOT be won. This type of fraud makes up 29% of all chargebacks.

How can your business PREVENT chargebacks?

Properly Process Transactions

The Payment Card Industry advises that businesses NEVER write down credit card numbers, so for any mail/telephone (MOTO) orders, make sure you process payments promptly. You’ll also want to ensure careful data entry. Keying in an extra zero on a $100.00 transaction will cost you more in processing fees and is sure to raise a red flag when your customer is reviewing their receipt or statement.

Finally, for card-present transactions, always dip EMV chip cards. The additional security provided by EMV technology helps to prevent fraud. In the event of an EMV payment dispute, your business is not liable if the card was dipped. However, if an EMV payment is disputed and the card was swiped, you’re still liable for the full dispute amount.

Adjust Your Receipts

Clearly mark your website, invoices, email signatures, and receipts with your DBA name. This is the name that your customers know your business by. For example, if the legal name of your construction business is John. A Doe, but your storefront and website list the business name as Doe Construction, Doe Construction is the name that should appear on your receipts, invoices, etc. Be sure to include a valid email address and phone number, so confused or frustrated customers will have a way to reach out to you BEFORE they decide to issue a chargeback.

Focus on Customer Service

If a client cannot reach you with a complaint, they may reach out to their credit card company to issue a chargeback instead. Be open to compromise when it comes to your refund policy. A partial refund still leaves you with more money than a lost chargeback.

Above all, do everything within your power to deliver fantastic customer service. Satisfied customers won’t want to destroy the good relationship they have with your business by issuing a chargeback.

Get Organized

Keep meticulous records. You have a limited window of time to respond to a chargeback, and the first chance is your only chance when it comes to submitting your “rebuttal” documentation.

Emails, receipts, invoices, purchase orders, refund policies, etc. should all be readily available. Organization and timeliness are your best tools when protecting your business against chargebacks.

Implement Fraud Prevention

A chargeback that results from true fraud or identity theft CANNOT be won. In this scenario, the business and cardholder are BOTH victims, but your business will be stuck footing the bill. In the case of true fraud, your best option is to catch the transaction before it ever goes through.

Implementing a fraud prevention program

Utilize Technology

Buying stolen credit card numbers is easier than ever. Even just typing “buy credit card numbers” into the search bar provides a number of options for unsavory characters. However, while thieves can use technology to purchase stolen information, you can utilize it to protect your business.

Consider automating A/R processes. Established policies and procedures are only effective if they’re enforced across the board. Automating your A/R processes allows you to increase efficiency, improve revenue collection times, AND reduce risk.

For e-commerce businesses, CAPTCHA—which stands for Completely Automated Public Turing test to tell Computers and Humans Apart—is used to determine whether a user is a real person or a robot. Thieves often use “bots” to try hundreds, or even thousands of card numbers at once, searching for one that still works. CAPTCHA is designed to protect your website from this fraudulent practice.

Require CVV Codes

Many thieves turn to fraud for one reason—it’s easy. Even a simple deterrent can often be enough to discourage would-be fraudsters. This is where CVV codes can be invaluable for your business.

CVV stands for card verification value. You might also hear it referred to as the “CCV2” or the “security code.” The CVV is the 3-digit code on the back of a credit or debit card. The vast majority of fraudsters don’t have the physical credit card in their possession—they’ve either purchased a list of card information, hacked into another organization themselves, or skimmed it from a credit card terminal. In all of those scenarios, it’s rare for a fraudster to have the CVV code because businesses aren’t allowed to store it.

If someone cannot provide the CVV, you can conclude that they DO NOT have access to the physical card. While requiring a CVV match at checkout won’t protect you from cases of fraud where the physical card is present, it’s still a valuable tool for fraud prevention.

Final Thoughts

Your business doesn’t have to face the threat of fraud alone. A true credit card processing partner should offer multiple solutions to help prevent fraud and the risk of lost revenue that inevitably follows.

The chargeback process is notoriously confusing, and you only have a limited amount of time to respond with your rebuttal and documentation. Your business probably doesn’t have extensive experience with chargebacks, but your processor definitely should. And in the case of friendly fraud and chargeback fraud, that experience can prove invaluable to winning chargebacks and retaining your funds.

Before choosing a processor, ask about fraud prevention tools and how they will help you fight chargebacks. 71% of chargebacks are initiated by the actual cardholder, either as an oversite or with malicious intent. These are chargebacks that can often be won, and this is where your processor should have a chance to shine.