SURCHARGING

Reduce your credit card processing fees to almost nothing

Not all businesses have the cash margins to afford processing fees. Surcharging is designed to allow your customers to use their preferred payment method for purchases, without the need for your business to take on additional costs. This program allows you to pass those processing costs on to the customers who pay with a credit card, potentially saving you thousands of dollars a year.*

Surcharging features:

Reduced fees

Pass processing costs for credit cards directly to consumers at the time of sale.

Fully compliant

Surcharging complies with all industry requirements, including mandates by individual card brands and state laws.

World-class Support

Our team of seasoned experts will be there for your business, before and after setup.

No hassle

Our system recognizes debit cards for you, so you don’t have to worry about differentiating.

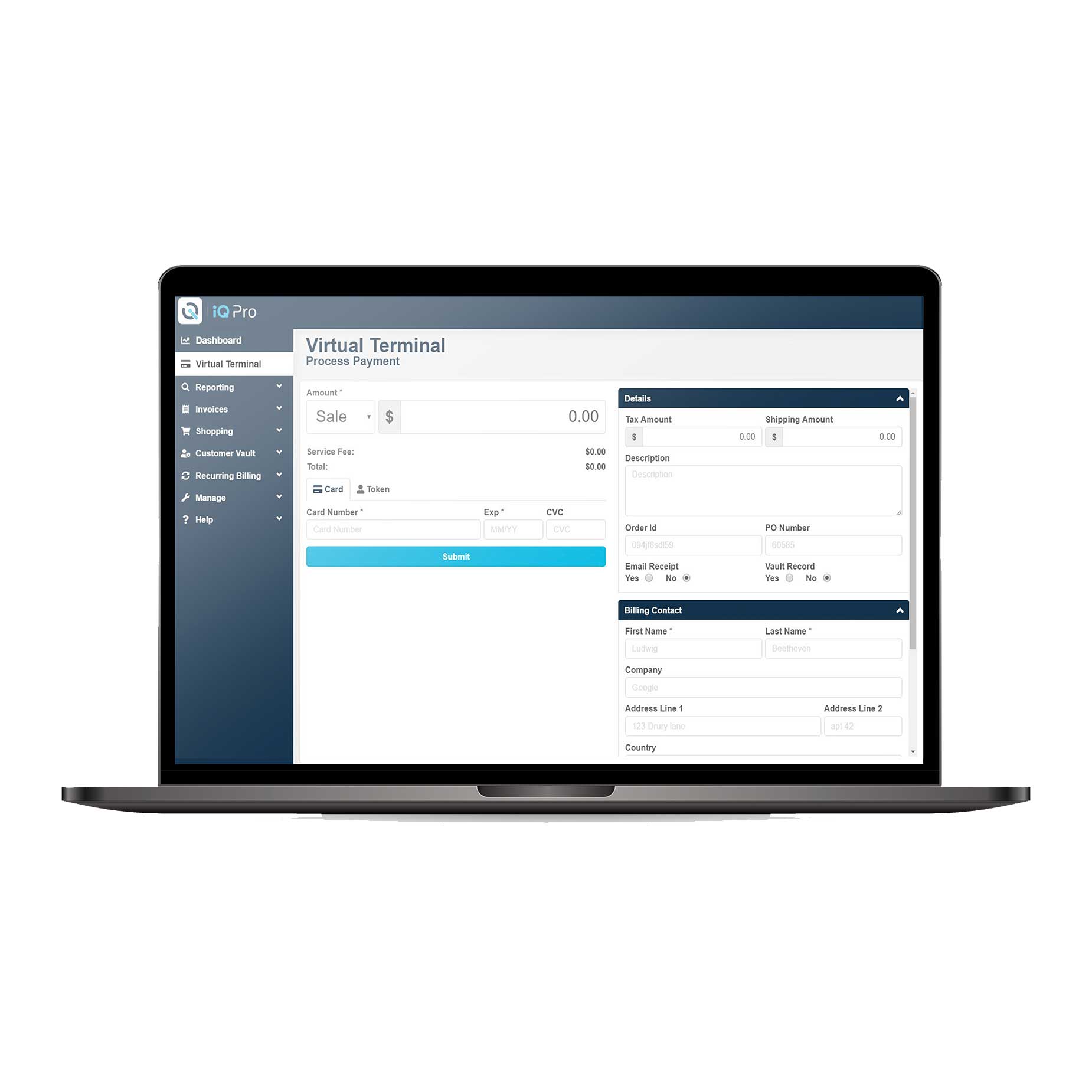

Supported Equipment for Surcharging:

*Surcharging is not permitted on debit cards. Certain state and/or local laws may prohibit merchants from assessing surcharge fees even if Card Brands allow it. Merchants should consult their legal counsel for restrictions. Merchants are responsible for fees related to iQ Pro, Clover, PCI Non-Compliance, ACH reject, Chargeback, and Retrieval. Merchants accepting tips must determine tip amount prior to adding surcharge. Tipping requires Clover Station Duo, Clover Mini, or Clover Flex. Equipment used for surcharging cannot share a Merchant ID with equipment that is not surcharging compatible. Merchants are required to disclose surcharging to customers.

^For all merchants EXCEPT iQ Pro Simple Pay – Surcharge to customers is 3.5%. Program offers a fixed rate to the merchant of 3.3816% for credit transactions, and 1.25% plus .25 per transaction for debit transactions. Merchants will receive deposits from daily business of total card volume, plus surcharges, minus discount fees. Merchants are responsible for fees related to iQ Pro, Clover, PCI Non-Compliance, ACH reject, Chargeback, and Retrieval. Merchants accepting tips must determine tip amount prior to adding surcharge. Merchants are required to disclose surcharging to customers.

+For iQ Pro Simple Pay ONLY – Merchants must have credit card processing volume greater than $5,000/month and an average ticket greater than $20 to be eligible for program participation. Program offers a fixed rate to the merchant of 3.89% for credit and debit transactions and is subject to a 30-day waiting period, per card brand regulations. Merchants will receive payment on all credit card surcharges with the funds from that day’s business. Merchant fees, including the 3.89% for credit and debit transactions, will be deducted on the 1st of the following month.

MEMBER FDIC/INTERNATIONAL BANCSHARES CORPORATION